The Reality of Agentic Search

Why Your Marketing Strategy is About to Change

In 2023, I wrote "How Do You Market to an AI Agent?" exploring how the shift from active searches to AI-driven recommendations would fundamentally reshape marketing. Now that agentic search is here, I'm seeing something that most marketers are still missing entirely.

The Multi-Agent Reality We're Actually Getting

Everyone's talking about AI agents, but here's the crucial misunderstanding: the agent you'll be marketing to isn't the friendly LLM you chat with.

Look at OpenAI's new agent model. It's not one AI doing everything - it combines three distinct technologies:

ChatGPT for communication

Deep research capabilities

Web search functionality

This pattern is everywhere in AI solutions now. What we're getting isn't a single superintelligent agent - it's multiple specialized agents working in concert:

Communication agents that interact with humans (friendly, conversational)

Management agents that determine task completion and workflow progression

Execution agents that actually perform searches, evaluations, and purchases

The Execution Agents: Your Real Target Audience

Here's what most marketers don't realize: the search and purchase agents won't be friendly like ChatGPT.

These execution agents will be mechanical, robotic, almost insect-like in their behavior. They'll be crawling, slithering, searching as efficiently as possible to resolve human or organizational needs. They're optimized for speed and accuracy, not conversation.

Because of this fundamental difference, the way they consume information is completely different from how humans (or communication agents) process content.

Where These Agents Are Actually Looking

AI engineers are telling us these agents search deep into web content - not the top-ranking Google results everyone obsesses over, but the longer, deeper, more detailed pages.

This is why everyone's saying "write more content" and "create Q&As." But I think they're missing the bigger picture.

The real goldmine is backend product catalog information.

These mechanical search agents are going to be reading through structured product data, but they need much more than basic specifications. They're looking for a comprehensive matrix of information - like individual cubbie holes for each attribute they can use to determine best fit.

What agents need includes:

Detailed product/service descriptions and specifications

Usage scenarios and contexts

User demographics and behaviors

Performance data and results

Legitimate research data - brands sponsoring statistically significant, academically robust research

Raw qualitative survey data and analysis with outcomes

Brand values and attributes for values alignment matching

Problem-solution mappings

The agents will examine multiple different attributes of both the product and brand to match the needs of the consumer, organization, or process they're serving. This includes everything from functional product attributes to alignment of values between the consumer and the brand.

The Amazon Advantage

Having comprehensive catalog information on Amazon is probably more critical now than ever before. Amazon's structured data format is exactly what these search agents need - detailed specs, categorization, reviews, and outcome data all in a standardized format.

This connects directly to what I predicted in 2023: "having your product information fed into and referenced across various databases will be key." Amazon has become the dominant product information database that AI agents will reference, and they're probably closest to creating a comprehensive stream of product attributes specifically designed for search agents.

Amazon already has catalog information for such a large percentage of available goods, giving them a massive advantage in creating the matrix of product information, usage data, specifications, brand values, and research that agents need to make optimal matches.

While everyone else is trying to figure out how to structure information for AI agents, Amazon already has the infrastructure these agents will consume. All this information must be accessible to agents crawling the web today, but in the future, someone (likely Amazon) is going to create a dedicated stream of product attributes specifically optimized for search agent consumption.

What to Watch For

Keep your eyes open for new services creating dedicated data streams for AI agents. When someone builds a platform that provides constant feeds of product and service information specifically formatted for agent consumption (JSON, APIs, structured data), that's where you'll want to be.

As I noted in my 2023 piece: "Whether it's a profit-driven database, an institutional one, or an awards-based repository, the broader the coverage across these platforms, the higher the likelihood of your product being recommended by AI agents."

The agents will know exactly where to go for reliable, standardized product intelligence.

The Strategic Shift

This isn't about writing better blog posts or climbing Google rankings. This is about preparing for a fundamentally different type of search entity - one that doesn't care about your brand story or marketing copy, but obsessively focuses on matching solutions to needs with mechanical precision.

The companies that understand this distinction - and structure their product information accordingly - will have a massive advantage as agentic search becomes the dominant discovery method.

The question isn't whether this future is coming. It's whether you'll be ready when these mechanical search agents come crawling through your data.

July Video Q & A’s

Two quick video responses to questions I received.

Can you Scale on Amazon without Discounting Your Price?

When Is A Brand To Early or To Late To Enter Amazon?

Newsletter - July 2025

A Fresh Perspective That Comes From Travel

A Fresh Perspective That Comes From Travel

Standing atop the Eiffel Tower last week, watching Paris sprawl endlessly in every direction, I was struck by something beyond the view. Here was a structure that shouldn't exist—an "eyesore" that sparked fierce debate when first erected, yet became the very symbol of its city through sheer persistence and reinvention.

The same thought hit me wandering through Mont-Saint-Michel Abbey, where medieval walls have weathered centuries of battering tides not by resisting the water, but by learning to work with it. These weren't just tourist stops on our family trip—they were masterclasses in adaptive resilience.

The parallel to our industry is impossible to ignore. The brands and retailers thriving today aren't the ones clinging to yesterday's playbook. They're the ones embracing the tide—whether that's the shift toward retail media, the complexity of modern marketplace dynamics, or the evolving expectations of customer engagement.

In this issue, I'll share the latest strategies and insights from companies that, like these enduring landmarks, have learned that survival isn't about standing still—it's about standing strong while moving forward.

Prime Day 2025: The Marathon That Paid Off (Sort Of)

Amazon's Prime Day 2025 just wrapped up, and the headlines tell two different stories. The good news? Record-breaking sales of $24.1 billion over four days—that's a 30% jump from last year and equivalent to "two Black Fridays" worth of volume (Barron's). The complicated news? The event felt more like a marathon than a sprint.

Here's what actually happened: Amazon stretched Prime Day from two days to four (July 8-11), and while 63% of shoppers appreciated the extra browsing time (JumpFly, Inc.), analysts are warning that longer events dilute the urgency that made Prime Day special. Day 1 alone brought in $7.9 billion (JumpFly, Inc.), but early sales were reportedly down 41% compared to 2024's opening day (Retail Dive).

The shopper behavior shift is telling. Over half of Amazon shoppers compared prices across Walmart, Target, and other competitors—a sign that the deal-hunting game has evolved (Barron's). Most purchases were under $20, with big-ticket items like appliances seeing the real growth (freezers up 160%, home security up 185%) (Barron's).

For B2B marketers, the takeaway is clear: Extended promotional windows can boost total volume, but they require different strategies. Brands that treated this as a strategic campaign—pacing ad spend and showcasing full catalog discounts—saw 2-4x revenue growth. Those with partial participation? Only 1.3-1.6x lifts (Acadia.io).

The bottom line: Prime Day 2025 succeeded in scale but lost some of its lightning-in-a-bottle energy. It's a reminder that in our attention economy, sometimes more time doesn't equal more impact—it just means you need smarter tactics to cut through the noise.

Growth Levers Missed By Mid-Market Brands

Planning for Back-to-School and Q4 Success

I hate being that dude saying that it's time to talk about back-to-school and it's just July, but the reality is you're gonna need to get your supply chain in order, get your pricing in order, get your selection in order. These are when you need to start making these decisions.

The Seasonal Shift is Here

Back-to-school season isn't just about notebooks and backpacks—it's a complete consumer behavior reset. Families are transitioning from summer routines to structured schedules, driving demand across categories from tech and apparel to food and home organization. This period serves as the crucial bridge between summer clearance and holiday build-up, making it your last chance to optimize before the year-end sprint.

Turn Prime Day Data Into Q4 Gold

Your Prime Day performance just handed you a roadmap for the rest of the year. Which products exceeded expectations? What inventory moved slower than anticipated? Use these insights to double down on winners and pivot away from underperformers. More importantly, identify which Prime Day successes can be repositioned for back-to-school bundles or early holiday gifting strategies.

Black Friday Prep Starts Now

While your competitors are still basking in Prime Day glory, smart brands are already sketching out their Q4 playbook. Black Friday and Cyber Monday deals don't materialize overnight—they require inventory forecasting, creative development, and strategic positioning that takes months to execute properly. Starting now gives you the runway to test pricing strategies, creative angles, and audience targeting before ad costs spike in November.

Your Back-to-School Action Plan

Inventory Audit: Ensure you have adequate stock for demand spikes, especially in high-velocity items that could sell out during peak periods.

Content Refresh: Update product detail pages, A+ content, and gather fresh reviews to maximize conversion rates when traffic surges.

Campaign Strategy: Develop ad campaigns that speak to lifestyle transitions—convenience, organization, fresh starts. Consider cross-category bundling opportunities that increase average order value.

Test and Scale: Use lower-cost July and August traffic to test messaging and creative before competition intensifies.

The brands that win Q4 are the ones making decisions right now. Prime Day gave you the data—now it's time to act on it before your competitors catch up.

Places We Can Meet In Person

📍 August 2025 – Chicago Collective (Chicago, IL)

The premier menswear trade show.

Meet top brands, discover trends, and network with global retailers.

📍 September 2025 – Amazon Accelerate (Seattle, WA)

Amazon’s flagship seller and brand conference.

Get the latest marketplace strategies, tools, and growth insights.

📍 January 2026 – Winter FancyFaire (San Diego, CA)

A celebration of specialty foods and beverages.

Perfect for brands seeking wholesale and retail expansion.

📍 February 2026 – SOURCING at MAGIC (Las Vegas, NV)

The industry’s largest apparel and accessories sourcing event.

Connect with global suppliers and manufacturers.

📍 March 2026 – Expo West (Anaheim, CA)

The must-attend event for natural and organic products.

Network with buyers and explore CPG and wellness innovations.

🌟 Local Spotlight – Detroit & Southeast Michigan

Expect multiple retail and e-commerce events through late 2025 and early 2026, focused on manufacturing, omnichannel retail, and marketplace growth. (Full schedule coming soon!)

A couple Fun Candid Photos from the trip:

Normandy Gas Station: Huge Chupa Chups and 1 Meter of Ibérique Pata Negra and Honfleur Port

Newsletter - May & June 2025

Judo Fighting With Amazon

Prime Day is your qualifying race; Q4 is the championship.

I hope you had a pleasant Memorial Day weekend. In the US Memorial Day is a time for reflection, remembrance, and community—and yes, the opening of many pools. In e-commerce, it’s also the starting gun for the sprint to Prime Day.

Now is the time to tighten the details, and invest time and money into your e-commerce marketplace offer:

Audit your product pages—make sure your content is accurate, compelling, and retail-ready

Review the customer journey—from search to checkout, where are the drop-offs?

“Walk your store”—inspect listings like a shopper would

Finalize your promo plan—discounts, coupons, and campaign timing

Check your inventory and fulfillment—are you stocked and ready to scale?

Align your marketing strategy—what channels, what message, and yes, TikTok Shop should be part of the plan

Then play out the “what ifs”:

What if you sell out of your hero SKU?

What if your B-side products don’t move?

What pricing levers or coupon strategies could you use to adapt?

Prime Day is where you test, learn, and earn your place. Q4 is where you win.

Invest the time and budget now to optimize your e-commerce engine. The brands that win Q4 are the ones that build the right habits—and customer expectations—today.

Let’s make this season count.

Margins, Manpower, and the Math Behind Amazon Growth

After some phenomenal conversations in Atlanta with cutting edge brands, I found myself having to review some of the same topics. And I wanted to highlight those here, below.When it comes to scaling a CPG brand on Amazon, the decision between selling direct or through a distributor has profound implications—not just on margin, but on control, growth, and investment.

Let’s break it down.

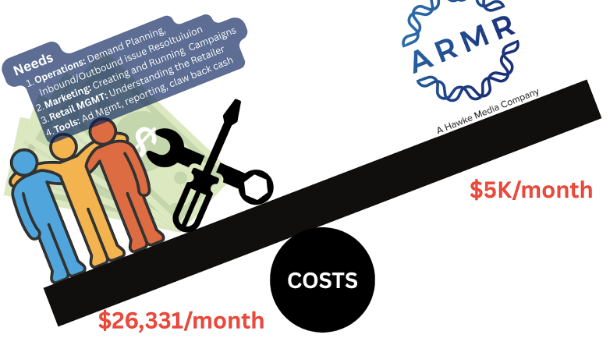

🧮 Margin Math: Distributor vs. Direct

In the current distributor model, you're making $5.50/unit in profit. The distributor takes over from there, capturing $10.99/unit as they sell the product for $19.99. That seems simple—until you consider what you're leaving on the table.

Selling direct may involve more complexity, but with a solid operational backbone, the unit economics flip. Even after accounting for fulfillment, ad spend, and our ARMR fee, you retain $2.25/unit in profit—and most importantly, you drive nearly 3x the revenue. Our model projects $90K in topline sales over 30 days vs. $34K through distribution.

And you keep the steering wheel: pricing, messaging, marketing, and consumer insights are all yours.

💼 The Cost of In House vs. ARMR’s All-In Team

Thinking about running this internally? You’ll need:

An ops expert for demand planning and issue resolution.

A marketer to build and optimize campaigns.

A retail strategist to navigate the nuances of Amazon.

Tools for reporting, clawbacks, and advertising automation.

That’s a $26,331/month overhead if you’re hiring a qualified team with tools. Or you can hire ARMR, a Hawke Media Company, for $5K/month—and get a proven, cross-functional team ready to execute today.

In short:

→ Distributors limit your growth and strip your control.

→ A direct model delivers more margin, more data, and more velocity.

→ The right partner (that’s us) costs a fraction of building it yourself.

Want to dig into your unit economics and see what’s possible?

Let’s walk through it.

FUTURE EVENTS:

🗓 Upcoming Events

📍 Week of June 9th

Private Event — Chicago

Interested in attending?

Email: Oscar@HawkeMedia.com for an invitation.

📍 June 18–20, 2025

Outdoor Retailer Summer Show

Salt Lake City, UT

Visit Website → outdoorretailer.com

Newsletter - April 2025

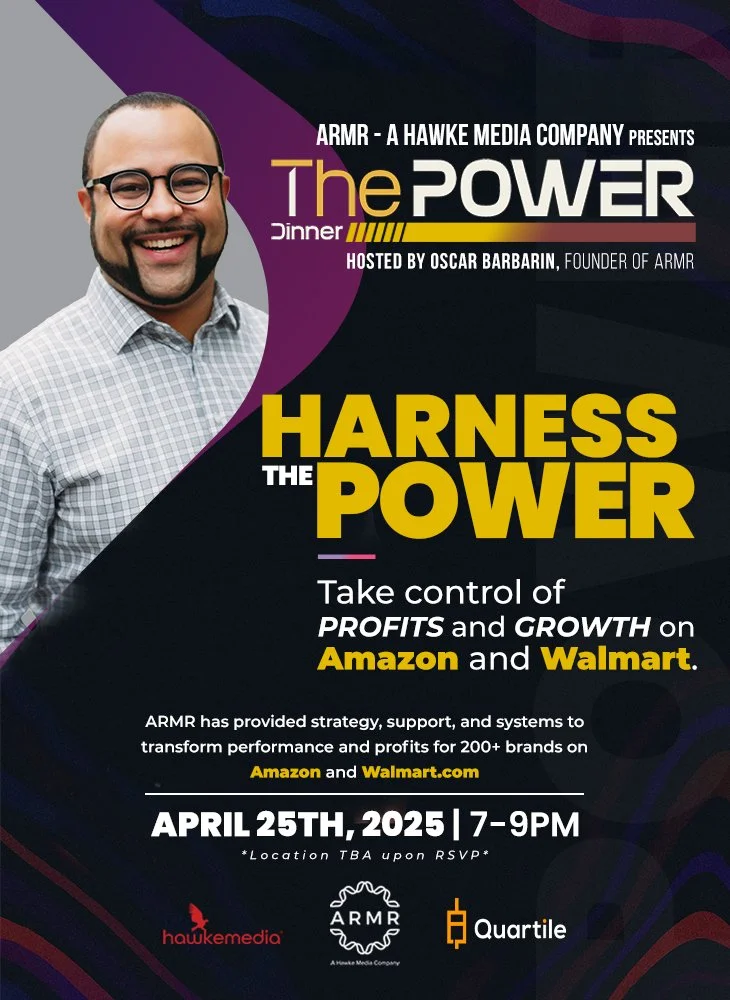

Power Dinner in ATL!

Your Marketplace Playbook: Power Dinner, Prime Day Prep, & Strategic Shifts

🥂 ATLANTA | APRIL 25

Private Power Dinner — Hosted by Oscar

If you're in Atlanta this week, I’m hosting a private dinner focused on real-world power — the kind that comes from clarity, action, and letting the right partners take the other fights off your plate. Reach out if you'd like to join.

🧠 MARKETPLACE STRATEGY INSIGHTS

SHEIN May 6 Webinar: What Every Brand Needs to Know

From Funnels to Networks: Shoppers now move through a journey shaped by influence: Stream → Scroll → Search → Shop. BCG report »

The New Marketplace Standard: Bazaars are out. Curated ecosystems are in.

Leadership Isn’t Portable: Success on Amazon doesn’t guarantee results on TikTok Shop, Walmart, or SHEIN.

Product-Market Fit Matters: Some platforms are better suited to specific categories — force-fitting leads to friction.

Execution Framework: Use a Customer × Platform × Fulfillment × Geography matrix to guide content, pricing, and profit.

🔥 SUMMER SETS UP YOUR WINTER

Prime Day is Expanding — Prep Now

Amazon’s Prime Day 2025 will run for four full days, giving brands extended exposure and customers more time to shop. This is your moment to set up Q4 momentum.

Key Actions:

Deals Due: Submit Prime Exclusive Best & Lightning Deals by May 23

Inventory Deadlines: FBA must arrive by June 9 (minimal splits) or June 18 (optimized splits)

Top Opportunities:

Best Deals (15% off min.)

Lightning Deals (20% off min.)

Prime Member Coupons (5% off min.)

Exclusive Price Discounts (15% off min.)

📘 View the full Prime Day Readiness Guide »

📦 FBA SHIPMENT CHANGES

Amazon to Start Charging for Incorrect Shipment Dimensions

Soon, if your provided dimensions are off, you’ll see a fee adjustment—either a credit or charge. View discrepancies in Inbound Performance > Inaccurate Transportation Weight/Dims. Rollout begins with 30-day notice.

📬 QUICK HITS FROM AMAZON

Amazon’s Latest Seller Updates, Summarized:

New Program: Seller Incentives Plus replaces Launchpad — benefits include Premium A+ access and $2K in ad credits for qualifying new brands.

Returns Reimagined: Join Amazon Renewed Webinars (May 8 & 9) to turn returns into revenue.

Canada KYC Updates: New verification rules for Amazon.ca sellers — 60 days to comply or risk deactivation.

SPP Migration: All third-party providers using Seller Central APIs must switch to Solution Provider Portal (SPP) by August 31.

📬 QUICK HITS FROM Walmart.com

🔍 Walmart Gets Smarter with Target ROAS Bidding (And So Should You)

Walmart is rolling out Target ROAS bidding—an AI-driven tool designed to help advertisers align spend with performance goals more precisely. This puts it in line with mature marketplaces like Amazon and Google. For brands or agencies already integrated via API, this could be a game-changer for margin-aware campaigns. For those not yet plugged in—time to get technical or get left behind.

🎯 Back-to-School Blueprint: Layered Media = Better Returns

Walmart’s case study on J.M. Smucker shows the power of omnichannel layering. By combining Homepage Features, Onsite Display, and Offsite DSP (including Pinterest), they drove a +48% ROAS vs. non-seasonal efforts. If you're not combining upper- and lower-funnel levers—especially during peak seasons—you're leaving returns on the table.

Newsletter - Febuary 2025

Creator Connections On Amazon

Creator Connections: Moving Budget from Speculative to Performance

The days of blindly throwing ad dollars into PPC campaigns and hoping for a return are over. Performance-based partnerships are here, and Amazon’s Creator Connections is giving brands and influencers a new way to collaborate with bonus commissions on top of Amazon’s standard affiliate rates. Instead of spending $13K on ads hoping for $130K in sales, brands can pay $13K in commission on actual revenue—a shift that removes speculation and puts performance at the forefront.

What Is Creator Connections?

Amazon’s Creator Connections is a free-to-join program that allows influencers and content creators to earn extra commissions by partnering with brands. Unlike traditional affiliate programs, this model offers exclusive brand campaigns, personalized partnerships, and additional financial incentives for creators.

Why It Matters:

✅ Access to Top Brands – Work with household names like Reebok, Microsoft, Anker, and more.

✅ Bonus Commissions – Earn extra payouts beyond standard Amazon affiliate rates.

✅ Content Control – Choose products that align with your audience and promote them on your terms.

The Reality: What Influencers Are Saying

While Creator Connections offers new opportunities, seasoned Amazon influencers are noticing growing pains in the program and the industry at large:

📉 Increased competition – More influencers mean video saturation, leading to fewer views per creator.

🔄 Amazon’s evolving algorithm – Frequent changes in video placement strategies impact earnings unpredictably.

🤖 Quality vs. Quantity Matters More Than Ever – The best-performing creators are focusing on high-value content, comparison videos, and cross-platform promotion (TikTok, YouTube, Instagram) instead of mass-producing product reviews.

How to Make Creator Connections Work for You

🔹 Repost and Repurpose Content – Top influencers maximize reach by sharing their content across multiple platforms and testing different posting times.

🔹 Diversify Revenue Streams – Successful creators aren’t just relying on Amazon—they’re also leveraging YouTube AdSense, TikTok Shop, and third-party affiliate programs.

🔹 Be Selective – Pick brand partnerships strategically. Prioritize products that align with your audience and that you genuinely believe in.

Is Creator Connections Right for You?

If you’re a content creator, influencer, or brand looking for a more performance-driven way to generate revenue, this could be a game-changer. But as with any emerging program, adaptability is key.

Want to know how to integrate Creator Connections into your e-commerce growth strategy? Let’s talk.

📸 Need Product Images? We’ve Got You Covered!

For just $2,500, get high-quality product images that make your listings stand out.

✅ 4 product families

✅ One color backdrop

✅ 2 days of shooting

✅ 1 day of editing

You won’t find a better deal for professional, marketplace-ready images. Let’s get your products retail-ready!

📩 Interested? Reply to this email, and we’ll take care of the rest.

🌍 CosmoProf 2025: Innovation, Trends & What’s Next

Like every year before it, CosmoProf 2025 delivered an incredible lineup of brands, manufacturers, and packaging experts pushing the boundaries of quality, creativity, and customer-centric innovation.

Beauty Is Personal—And It’s Evolving

Beauty isn’t just about aesthetics—it’s about identity, self-expression, and trust. Much like food, the products people choose are deeply personal, shaping their confidence and well-being. This year, it was exciting to see a shift toward cleaner, safer, and biologically impactful solutions, moving beyond surface-level marketing into true innovation.

🚀 Trends That Stood Out at CosmoProf 2025

🔹 Hair Color Explosion – Vibrant hues, natural tones, and specialty dye products were everywhere. The demand for self-expression through hair color is only growing.

🔹 Beyond Fruits & Plants: Fermentation & Animal-Derived Ingredients – Ingredient trends are evolving with a strong push toward:

📌 Fermented skincare and haircare solutions for enhanced bioavailability.

📌 Rendered ingredients from plant and animal sources making their way into formulations.

🔹 Bold & Bright Branding – Some regions are setting new standards in product storytelling and visual appeal with vibrant, highly expressive designs that could resonate strongly with U.S. audiences.

🔹 K-Beauty’s Science-Driven Minimalism – The clean, lightweight, lab-meets-nature aesthetic remains a core part of this space, blending cutting-edge science with a focus on simplicity.

🔹 Representation & Diversity on Display – More hair types, skin tones, and product applications were front and center, highlighting a push toward truly inclusive beauty.

🔹 Barber & Beauty Appliances on the Rise – More tools and devices than ever before were showcased, emphasizing a growing category in professional and at-home grooming.

🤖 How We’re Leveraging AI to Drive E-Commerce Success

AI isn’t just hype—it’s a strategic advantage. At Hawke Media, we’ve built and deployed custom AI tools to streamline e-commerce operations, enhance product detail pages, navigate complex contracts, and track competitor movements.

📌 AI-Powered Detail Page Optimization (Fully Deployed)

Our proprietary GPT automates 80% of product detail page creation, ensuring high-performing listings with optimized structure, content, and keyword placement.

✅ Smart keyword integration based on years of performance data.

✅ Concise, conversion-driven copy for better customer experience.

✅ Automated formatting & structuring for higher engagement.

This tool is already in full use, helping brands improve conversion rates and reduce manual content work.

📜 AI-Powered Contract Intelligence (Partially Deployed & Refining)

We’ve structured the full UNFI, KeHE, and US Foods vendor agreements into our AI system, making them instantly searchable and interactive for contract compliance and operational planning.

🔹 Scenario Simulation – Want to know what happens if a shipment is shorted, back-ordered, or canceled? Our AI enables "what-if" analysis to assess risks before they impact operations.

🔹 Real-Time Contract Q&A – No more digging through PDFs—ask specific questions, and the AI pulls relevant clauses in seconds.

This tool exists and is actively being refined to provide even deeper insights into profitability, assortment decisions, and vendor negotiations.

📊 Competitive Intelligence & Promotional Monitoring (In Development)

We’re building an AI-driven competitive tracking system that monitors and analyzes competitor marketing campaigns in real time.

🔹 Automated Tracking – Capturing promotional emails, texts, and digital ads to reveal pricing strategies, promotional timing, and content trends.

🔹 Data-Driven Adjustments – Helping brands pivot their pricing and promotional efforts based on real-time competitor insights.

While this initiative is still in development, it will soon give brands unprecedented visibility into market movements.

AI Is Changing the Game—Are You Ready?

From e-commerce optimization to contract compliance and competitive insights, we’re using AI to solve real business challenges. If you want to see how these tools can impact your bottom line, let’s talk.

📅 What’s Next: Upcoming Events

🔹 Expo West 2025 – March 4-7, Anaheim

The leading trade show for natural and organic brands, showcasing the latest in food, beauty, and wellness. A great space for emerging brands to connect with retailers and expand their market presence.

🔹 Prosper Show 2025 – March 25-27, Las Vegas

A must-attend event for brands selling on Amazon, featuring top industry experts, networking opportunities, and cutting-edge strategies to scale your e-commerce business.

Planning to attend? Let’s connect!

Newsletter - December 2024

Navigating the Evolving E-commerce Landscape: TikTok Bans, Seller Angst, and Channel Strategies

Navigating the Evolving E-commerce Landscape: TikTok Bans, Seller Angst, and Channel Strategies

The world of e-commerce is shifting rapidly, with sellers voicing growing concerns and exploring new strategies to stay competitive. Here’s what’s driving the conversation right now…

TikTok Potential January 19th Ban Sparks Uncertainty

Federal Court Rejects TikTok’s Bid to Halt January 19 Ban: What It Means for E-Commerce Brands

TikTok Shop (TTS) has emerged as a powerful driver of sales and marketing for brands integrating it into their multi-channel strategies. However, uncertainty around its future due to a potential U.S. ban is forcing businesses to hit pause on critical investments. With stability, brands could move full steam ahead on platform adoption and innovation.

The Ban: What’s Happening?

President Joe Biden signed a bipartisan-supported law requiring TikTok to either divest from its Chinese parent company, ByteDance, or face a nationwide ban. This follows former President Donald Trump’s previous, unsuccessful attempt at a similar ban. The latest legal blow came when a federal appeals court rejected TikTok’s emergency bid on December 9 to delay the ban, which is set to take effect January 19. If no further legal action succeeds, TikTok will vanish from major app stores.

Implications for Brands

The potential ban raises serious challenges for brands banking on TikTok’s dynamic e-commerce environment. Companies still assessing how to optimize TikTok Shop may delay key campaigns or redirect budgets toward other platforms like Instagram Shopping or Amazon Live or Haul.

However, ByteDance’s deep investment in TikTok's U.S. presence suggests the company is unlikely to exit the market quietly. Ownership restructuring or strategic partnerships could emerge to preserve the platform’s U.S. operations.

What’s Next?

While legal and political battles continue, brands should monitor the situation closely and prepare contingency plans. Diversifying platform strategies now could mitigate potential disruptions and ensure continued digital growth.

Actionable Insight: Stay nimble. Diversify your social commerce portfolio while keeping a close eye on TikTok's evolving legal status. Consider testing other emerging platforms to maintain a competitive edge.

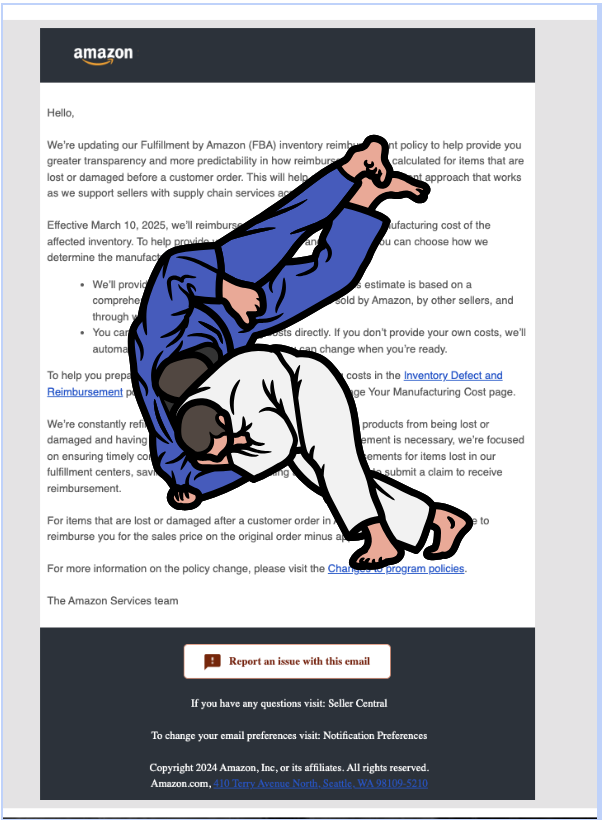

Amazon’s Latest Judo Move: Shifting FBA Reimbursement Policy to Manufacturing Costs

Amazon has long been a master of control, meticulously managing its supply chain. Now, in a bold shift, **starting March 10, 2025**, reimbursements for lost or damaged FBA inventory will be based on manufacturing costs (COGs).

Premium Products Should Be Concerned

What’s Changing?

Cost-Based Reimbursement: Amazon will reimburse based on manufacturing costs (COGs), not retail value.

Amazon’s Estimates: If sellers don’t provide their costs, Amazon will calculate them using industry averages.

New Portal: The Manage Your Manufacturing Cost tool launches in January for sellers to input COGs.

Why This Matters

Amazon’s push to know your costs gives it a stronger foothold in controlling seller behavior. With access to sellers' profit structures, Amazon can:

Benchmark and standardize costs across product categories.

Pressure sellers with higher COGs to cut expenses.

Potentially penalize “outlier” products that deviate from category norms.

Challenges for Sellers

Distributors Are Vulnerable: Their naturally higher COGs could be disproportionately flagged.

Gamesmanship Risk: Sellers may inflate costs to manipulate reimbursement benchmarks.

Innovation Threatened: Premium products with higher COGs may face unfair scrutiny.

How to Stay Ahead

Be Strategic: Provide manufacturing costs carefully, focusing on accuracy and positioning.

Protect High-Value Products: Monitor how Amazon handles premium items in your category.

Leverage Tools: Automate responses to Amazon flags on “high-cost” items to streamline negotiations with suppliers.

If you’re wearing rose-colored glasses, Amazon’s move to reimburse based on manufacturing costs (COGs) could be seen as a way to lower customer prices. A more cynical perspective suggests Amazon may use COG data to expand its private label offerings efficiently and understand how much margin is left to squeeze from sellers. By setting internal target margins for sellers, this approach, initially informational, could soon become a required metric—forcing products to align with average costs or lower, and potentially disadvantaging premium items.

As always, where there’s a judo move, there’s an opportunity to counter. Let’s see what tools and strategies emerge. There’s potential for tools that automate supplier notifications when Amazon flags a product for high costs. Such tools could help sellers start cost-reduction conversations, making it easier to adapt to Amazon’s evolving standards.

Seller Frustrations Are Boiling Over

Industry Concerns Mount Over Amazon's Treatment of Sellers

Key concerns are intensifying among industry insiders about Amazon’s treatment of sellers:

Profitability Pressures: Fees, rising shipping costs, increasing advertising investments, and tightening economic conditions are squeezing sellers’ profit margins, while operational inefficiencies continue to escalate.

Amazon Warehouse Distribution (AWD) Performance: Sellers are increasingly concerned about AWD's reliability, complicating their fulfillment strategies.

Logistical Delays: Recent shipping performance, particularly during major events like Black Friday, has been a significant point of frustration. Sellers report delayed shipments from Amazon fulfillment centers, which has resulted in discrepancies between recorded sales volume and actual transactions due to unfulfilled orders.

A recent industry post captured this growing sentiment, highlighting how shrinking profitability and unreliable logistics are forcing sellers to rethink their business models. What sets this wave of dissatisfaction apart is its depth, the clarity with which sellers are articulating their struggles, and the sheer number of voices expressing concern.

Different Content Channels - Different Goals

Sellers today are embracing a multi-channel strategy to meet customers where they are, tailoring their approach to the unique environment in which their product information is consumed. The magic lies in understanding that different platforms frame the customer's expectations differently, requiring aligned content, pricing, and offerings.

TikTok Shop excels at driving product trials through short-form video content, where consumers prefer smaller samples at accessible prices. In contrast, YouTube’s broad reach makes it ideal for mass-market storytelling and brand awareness.

This approach extends beyond digital platforms. Whether customers are on Amazon, shopping in-store, or engaging with content-driven platforms, content and format must match their expectations. To maximize reach efficiently, sellers should streamline offerings into three core variations: large wholesale quantities, mid-tier options, and sample-sized entries.

Tech Tools Making a Difference

Carbon6’s Advanced Tools: Empowering Brands with ARMR, a Hawke Media Company

Free PixelMe Audits: ARMR, a Hawke Media Company, offers complimentary audits of PixelMe to help brands optimize their digital ad performance. PixelMe enables:

Precise audience targeting and retargeting

Actionable insights to enhance ROI

This free audit reviews pixel performance metrics and identifies opportunities to maximize the impact of every ad dollar.

Prime DSP Solutions at an Unbeatable Price: Carbon6’s DSP stands out for its extremely accessible price point—1/4 to 1/5 of industry norms. Features include:

Advanced algorithms for data-driven ad campaigns

Cutting-edge optimization to reach high-value audiences

ARMR leverages this powerful tool to deliver exceptional results, offering premium DSP capabilities without the premium price. Together, these tools provide unparalleled value for marketplace advertising.

[IMAGE]

Controversial Corner:

Capturing the Curious Consumer

In a world of endless scrolling, most consumers are on autopilot, moving from one laugh, rage, or viral moment to the next. But a select few are in curiosity mode—open to discovering new ideas. These are your golden opportunities.

Strategic product placement in repetitive, interest-driven content—like a unique shape of surf wax in the background of surf videos—plants the seed of intrigue. Over time, curiosity builds: What is that? Why do they use it? When consumers actively seek out your product, you've won their attention.

To execute this effectively, your product must have a distinct, recognizable feature—like a unique shape, bold color, or memorable design. Then, align your SEO strategy with those standout elements so that when curiosity strikes and consumers search, you are front and center. Let curiosity lead them to you.

Industry Insights & Events

Limited-time coupon fee reimbursement for new FBA selection

From now through January 31, 2025, Amazon will automatic reimburse FBA Sellers $0.60-per-redemption coupon fee for coupons on newly launched Fulfilled by Amazon (FBA) selection. The promotion applies to FBA offers on products that first became buyable after November 2, 2024. Read more.

Amazon Science and COSMO’s Initiatives

If you haven’t explored Amazon Science yet, it’s a hub of groundbreaking research shaping the future of e-commerce.

For anyone interested in AI, technology, or e-commerce, Amazon Science is essential reading.

Amazon’s COSMO: Common Sense Knowledge - Finding User Intention

COSMO is Amazon's internal system for generating and deploying e-commerce-specific commonsense knowledge, leveraging fine-tuned large language models and user behavior data to bridge the semantic gap between customer queries and product information. It enhances search relevance, product recommendations, and navigation across 18 product categories, indirectly benefiting sellers by optimizing product visibility and alignment with customer intent.

1. User Intent and Behavioral Data Integration

User Intent Capture: COSMO generates commonsense knowledge from user behaviors like search-buy (queries leading to purchases) and co-buy (frequently bought together).

This knowledge bridges the semantic gap between user search queries and product listings, enabling better content alignment.

Impact:

Optimize product detail pages (PDPs) to match user intent.

Refine keywords and product attributes to improve search relevance and conversion rates.

2. Query-Product Relationship for Content Enhancement

COSMO introduces structured relation types (e.g., "used_for," "capable_of," "is_a") to explain product functions and user needs.

Example: "Winter coat → provides warmth in cold weather."

Impact:

Enhance A+ Content by explicitly addressing how a product meets customer needs.

Improve bullet points and titles with specific, intent-driven information.

3. Scalable E-commerce Knowledge Graph (KG)

COSMO expands knowledge across 18 product categories (e.g., Electronics, Home & Kitchen, Clothing).

Generates millions of high-quality relations with low annotation cost.

Impact:

Use this knowledge to guide content strategy for multiple categories on Amazon.

Target content updates for products in high-opportunity domains based on user intent signals.

4. Search Relevance and Navigation Improvement

COSMO improves search relevance by augmenting query-product matching with commonsense knowledge.

Reduces semantic gaps in ambiguous queries like "camping gear" → "winter camping air mattress."

Enhances multi-turn navigation by dynamically refining search queries.

Impact:

Guide clients on improving product discoverability with tailored keywords.

Advise on backend search terms and attribute tagging to align with user behaviors.

5. Session-Based Recommendations

COSMO enhances session-based recommendations by incorporating search queries and user interactions.

Generates intent-specific knowledge for query-product pairs to predict the next purchase.

Impact:

Optimize cross-selling strategies for products frequently bought together.

Use session insights to recommend complementary or related items effectively.

6. Practical Applications for Agencies

COSMO can inform:

PDP Content Refinement: Use generated intent knowledge to improve titles, bullet points, and A+ Content.

SEO Optimization: Align keywords with user behaviors for better search visibility.

Ad Targeting: Use search-query intent to fine-tune retail media campaigns.

Product Bundling: Identify co-buy relationships to create effective bundles.

7. Revenue Impacts and Scalability

COSMO’s deployment in Amazon’s search navigation resulted in:

0.7% increase in product sales (hundreds of millions in revenue).

8% increase in navigation engagement.

Impact:

Validate strategies for content updates and search optimization with measurable KPIs.

Events

Stay ahead by attending these key industry gatherings:

Winter Fancy Food Show - Las Vegas, Jan 19-21, 2025

COSMOProf - Miami, Jan 21-23, 2025

Expo West - Anaheim, Mar 4-7, 2025

Want More Insights? Looking to discuss these topics further or share your perspective? Connect with us [insert link].

Newsletter - November 2024

Amazon's 12 Days of Black Friday Event.

As Autumn grows older , it's the perfect time to give thanks and give back.

It's also Amazon's 12 Days of Black Friday Event.

Kicking off 7 days before Thanksgiving and extending 5 days beyond, straight into Cyber Monday. The selling season has lengthened, for better or worse.

Article #1: hold the presses – are pigs flying - Amazon is NOT increasing fees for 2025

They must've heard the grumbling from the sellers because they have decided to hold on fee increases.

Amazon’s Fee Update for 2025: Stability, Simplicity, and Savings for Sellers As we look back on 2024, Amazon’s partnership with sellers led to record-breaking sales and significant enhancements in customer experience. For 2025, Amazon is prioritizing simplicity and stability, aiming to reduce your operational burdens and costs.No Fee Increases in 2025: Amazon has committed to not raising referral or FBA fees in the U.S. and will also lower some costs while providing more benefits for new selection growth.Key Updates for 2025:

Reduced inbound placement fees for bulky products.

Waived fees for new ASINs in the FBA New Selection Program.

New incentives for adding high-demand products and expanding popular brands.

Amazon continues to innovate for sellers, including enhanced tools for fee calculation, efficient inbound shipping, and expanded seller benefits—all focused on making it easier for you to succeed.For more details on the 2025 fee changes, visit amazon.com/selling-fee-changes.

Article #2: AWD - Amazon Warehousing & Distribution

The team and I had a call with the Amazon team. Capital-intensive operations are Amazon's jam, and AWD fits right in. They're working to make the supply chain more vertically integrated: Regional Distribution Centers feed Intermediate Warehouses, which then handle replenishment or order fulfillment.

Amazon is heavily supporting this program, and they'll keep adding value by two routes: increasing the challenges for those not using AWD, and reducing headaches and costs for those who do.

Who Should Use AWD?

As of today, AWD isn't for everyone, but for sellers dealing with customs, mixed pallets, and international logistics, it's a valuable tool. You can send mixed pallets without worrying about allocation—critical for customs. If customs cuts open your shipment and mixes the units, AWD ensures it all gets sorted smoothly, avoiding logistical issues.

Another perk? Avoiding inventory placement fees. AWD lets you send mixed pallets in, bypassing some costs. But remember, you'll still pay referral and storage fees once products move to fulfillment centers. Best practice: keep 8-12 weeks of inventory in AWD to ensure smooth replenishment.

Our Thoughts?

We do plan to explore it heavily for our clients and see how allocation of inventory there can help improve total profitability.

Why AWD Stands Out

Mixed Pallets: Send in mixed pallets without added stress.

Avoid Placement Fees: Save on fees and streamline inventory.

Customs Solution: Border Patrol and Customs mixing up your shipments? AWD provides the flexibility to adjust

For sellers facing complex logistics, AWD provides a practical advantage. Learn more here: Amazon Warehousing & Distribution.

Happy Thanksgiving!